This first module talks about preparing for your Retirement Life. A key part of this preparation is to gain an understanding of the challenges that come when we transition from working life to a life in retirement.

Course Content

Readiness for Change

You don't currently have access to this content

Identity Issues

You don't currently have access to this content

Relationships at Home

You don't currently have access to this content

My Social Networks

You don't currently have access to this content

Health: The M Word

You don't currently have access to this content

Health: The P Word

You don't currently have access to this content

Money Issues

You don't currently have access to this content

Understanding Pensions

You don't currently have access to this content

Tax Made Simple

You don't currently have access to this content

Social Welfare Matters

You don't currently have access to this content

Checklist: Our Home

You don't currently have access to this content

Checklist: Wills and EPA

You don't currently have access to this content

My Goals in Life

You don't currently have access to this content

Time to Plan

You don't currently have access to this content

Working after Retirement

You don't currently have access to this content

Marketing Myself

You don't currently have access to this content

The Role of Nutrition in Active & Healthy Retirement

You don't currently have access to this content

Nutrition in Retirement

You don't currently have access to this content

Micronutrients: Vitamins & Minerals

You don't currently have access to this content

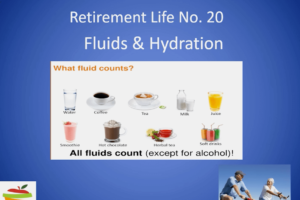

Fluids & Hydration

You don't currently have access to this content